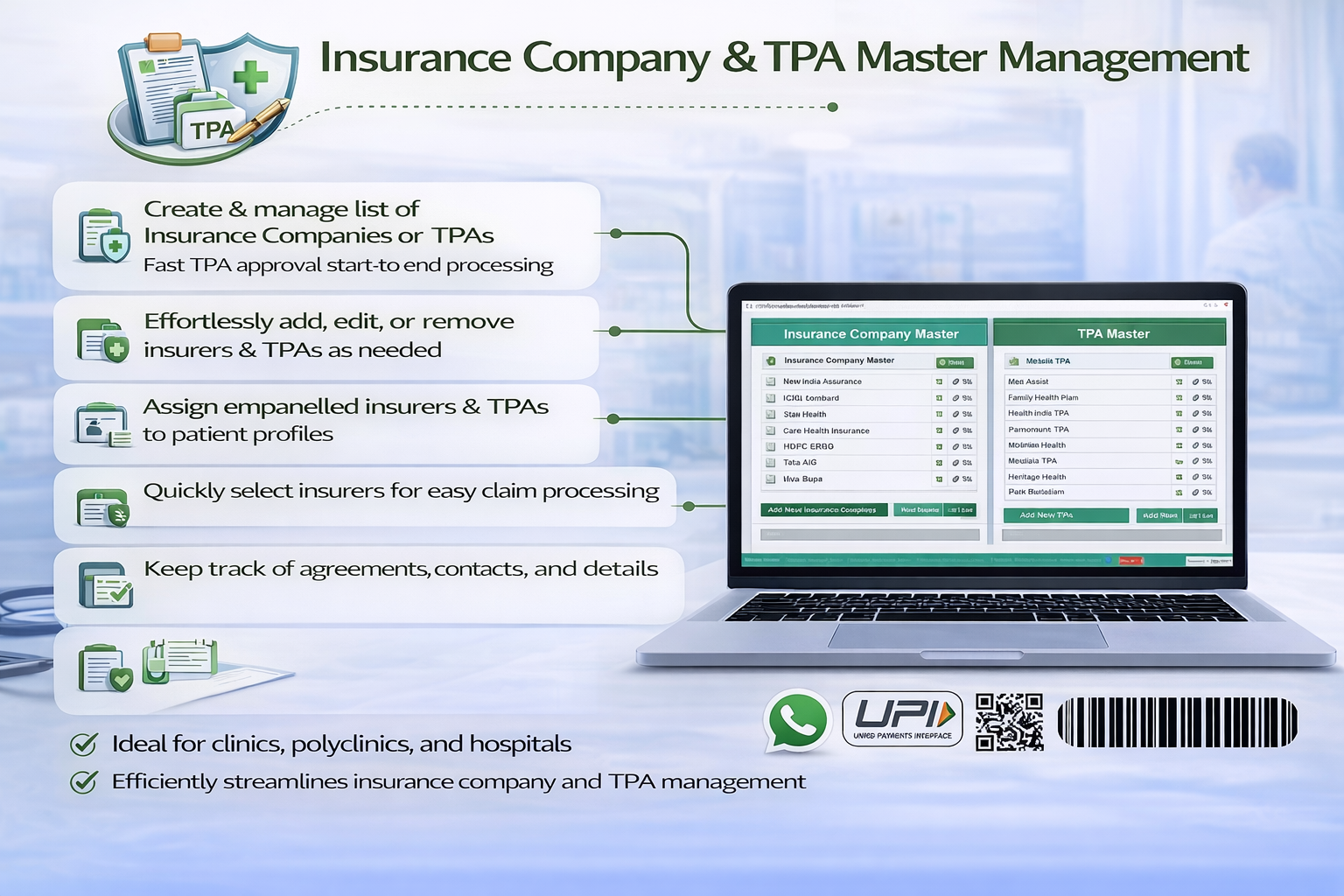

TPA & Insurance Management Software for Faster Cashless Approvals & Claim Settlements

Insurance and TPA workflows are complex, time-sensitive, and documentation-heavy. SWI Hospital Management Software digitizes the complete insurance lifecycle from pre-authorization to final settlement.

Reduce claim delays, avoid rejections, and improve cash flow with a fully integrated TPA & Insurance module.

Request Insurance Demo